Inheritance tax returns

Service features

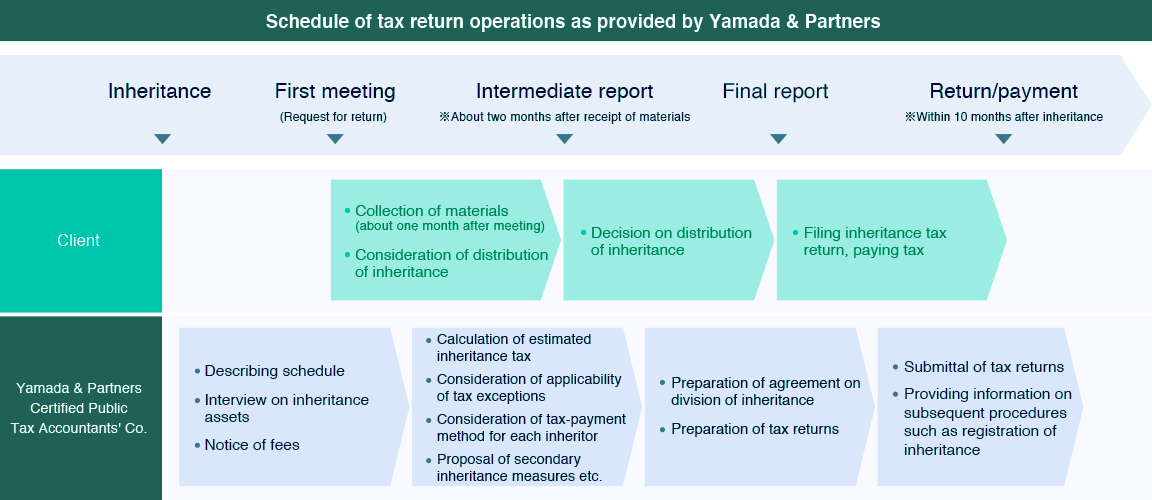

Service flow

Service menu

-

A strong track record

Our strong track record includes handling more than 2000 inheritance-related cases (including inheritance tax returns and inheritance/business succession consulting) per year.

-

Considering value from a wide range of perspectives

We consider valuation of assets (particularly land and stock) from a wide range of legal perspectives.

-

Identification and consideration of problems

In inheritance tax returns, we consider matters that could become problems in subsequent tax audits (e.g., whether any name deposits are involved and legal status of past inter vivos gifts) from a wide range of perspectives.

-

Proposal of measures, advice

More than just assisting with inheritance tax returns, as requested by our clients we also offer proposals and advice on distributing inheritance (e.g., effective use of devaluation exception for small residences and other properties and distribution methods based on secondary inheritance and other measures) and payment of taxes (e.g., deferred payment, payment in kind).

-

Appropriate tax audit assistance services

Based on our wealth of knowledge and experience, we assist clients with tax audits after filing inheritance tax returns.

-

One-stop services

In cooperation with other companies in the Group, we deliver one-stop services on procedures for changing title to real estate and financial assets.

-

International inheritance services

Together with providing appropriate tax advice for cases such as when the inheritor owns assets overseas or resides overseas, we also prepare and support inheritance tax returns for Japan and other countries.

CONTACT US

Feel free to contact us with any inquiries on taxes, accounting, etc.