-

1.

Business succession

Able to identify potential M&A needs swiftly from activities related to business succession of second-tier firms and SMEs

-

2.

Tax advising

Able to identify reliable M&A needs from tax consultation clients (both publicly traded and privately held)

-

3.

Nationwide services

With offices in the major cities of Japan, we can seek out M&A information and provide related services using our nationwide network

-

4.

Owner firms

We have a solid understanding of the circumstances of owner firms based on providing them with business succession consulting and tax advisory services

-

5.

Cross-border M&As

Our proper staff permanently stationed in overseas facilities make it possible to control M&As from the Japan side

-

6.

Flexibility

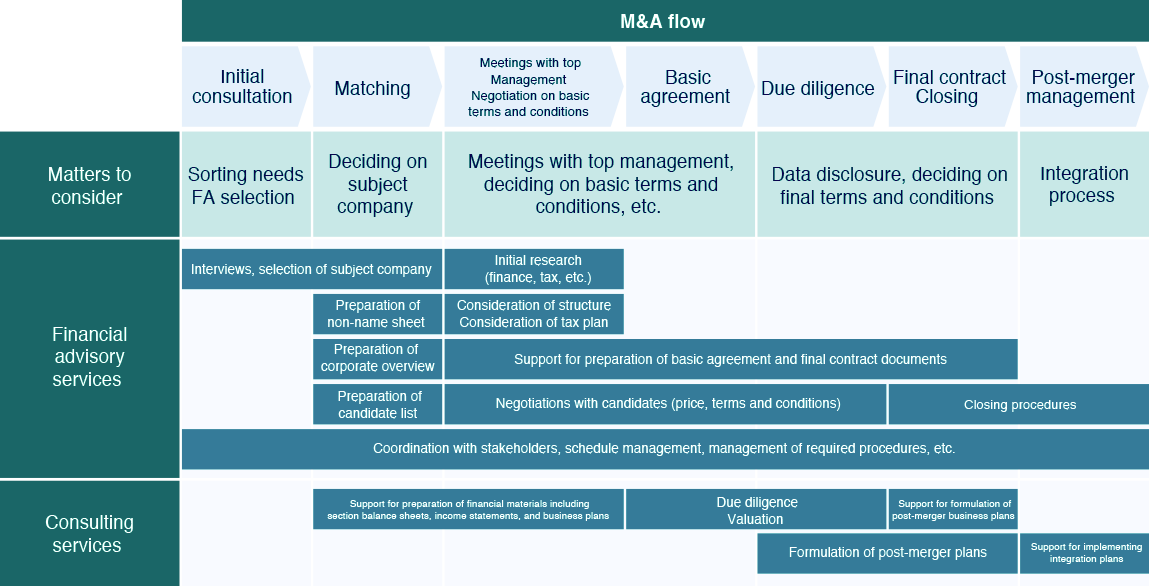

We can handle everything with flexibility from focused M&A services (e.g., due diligence, valuation) through complete services